Navigating Greene County, NY: A Comprehensive Guide to the Tax Map

Related Articles: Navigating Greene County, NY: A Comprehensive Guide to the Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Greene County, NY: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Greene County, NY: A Comprehensive Guide to the Tax Map

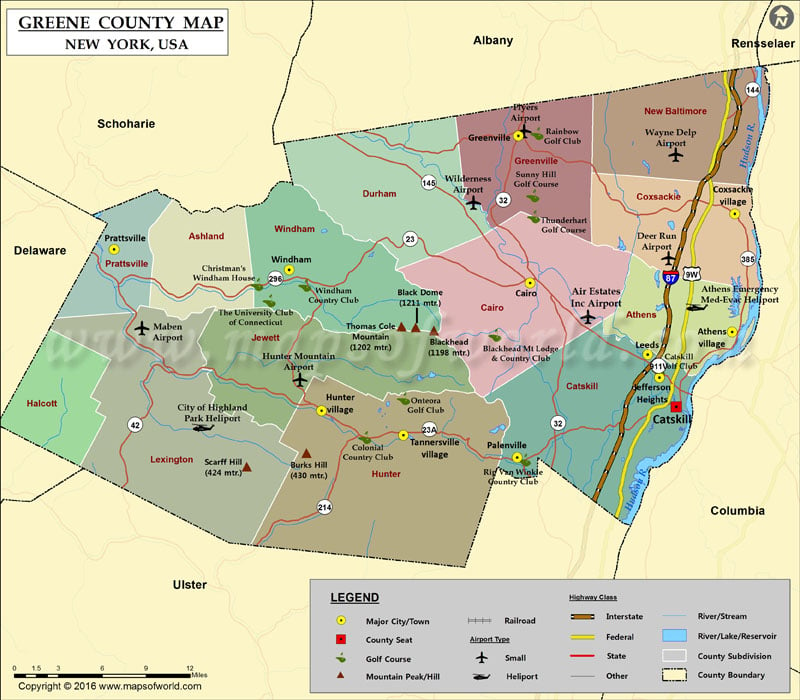

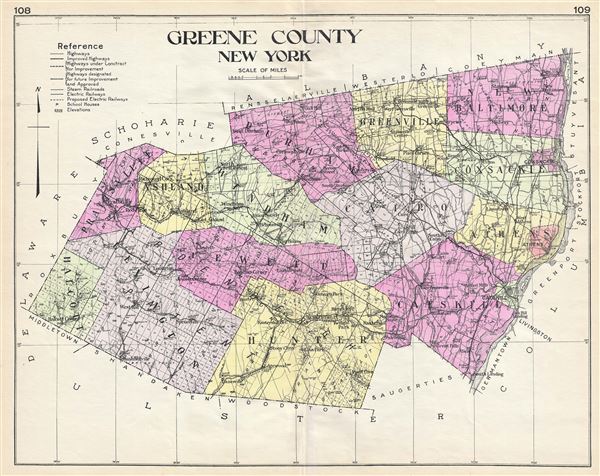

Greene County, nestled in the picturesque Hudson Valley, is known for its rolling hills, charming towns, and abundant natural beauty. Understanding the intricate landscape of this region is crucial for residents, businesses, and visitors alike. The Greene County Tax Map, a vital resource, serves as a visual and informational guide, providing a detailed breakdown of property ownership and boundaries within the county.

Understanding the Greene County Tax Map: A Visual Guide to Property

The Greene County Tax Map is a comprehensive system that visually represents the county’s land parcels. It’s a critical tool for various stakeholders, including:

- Property Owners: The tax map provides a clear visual representation of their property boundaries, ensuring accurate understanding of their land ownership.

- Real Estate Professionals: Real estate agents and brokers use the tax map to identify properties, assess their size and location, and understand potential development opportunities.

- Government Officials: The map is essential for tax assessment, zoning regulations, and land use planning. It helps in efficiently managing and allocating resources within the county.

- Public Access: The tax map is readily available to the public, facilitating informed decision-making related to property ownership, investments, and real estate transactions.

Key Features and Components of the Greene County Tax Map:

The Greene County Tax Map is a complex system that encompasses several key elements:

- Parcel Identification Numbers (PINs): Each individual property within Greene County is assigned a unique PIN. This number serves as a primary identifier, linking the property to its associated tax information, ownership details, and geographic location.

- Boundaries and Dimensions: The map accurately depicts the boundaries of each property, including its shape, size, and relationship to neighboring parcels. This information is crucial for accurate land surveying, property valuations, and development planning.

- Land Use Classifications: The map categorizes land into various usage types, such as residential, commercial, agricultural, or industrial. This classification system helps understand the zoning regulations and potential development restrictions associated with each property.

- Ownership Information: The map provides details about the current property owners, including their names and addresses. This information is essential for communication, tax collection, and legal matters related to property ownership.

- Tax Assessment Information: The tax map integrates with the county’s tax assessment system, providing information on property values and tax liabilities. This information is critical for property owners to understand their tax obligations and for the county to ensure equitable tax collection.

Accessing the Greene County Tax Map: A User-Friendly Experience

The Greene County Tax Map is readily accessible to the public through various channels:

- Greene County Website: The official website of Greene County provides online access to the tax map, allowing users to search for specific properties using PINs, addresses, or other criteria.

- Greene County Assessor’s Office: The Assessor’s Office offers in-person access to the tax map, providing assistance in navigating the system and interpreting its information.

- Third-Party Mapping Services: Several online mapping services, such as Google Maps or Bing Maps, integrate with the Greene County Tax Map, providing a user-friendly interface for exploring the county’s land parcels.

FAQs: Addressing Common Questions about the Greene County Tax Map

Q: How do I find my property on the Greene County Tax Map?

A: You can search for your property using the PIN, address, or owner’s name on the Greene County website or by visiting the Assessor’s Office.

Q: What information is included on the tax map about my property?

A: The tax map provides information about your property’s boundaries, size, land use classification, ownership details, and tax assessment information.

Q: Can I access the tax map on my mobile device?

A: Yes, the Greene County website and third-party mapping services are accessible on mobile devices, allowing you to view the tax map from anywhere.

Q: What are the benefits of using the Greene County Tax Map?

A: The tax map provides clarity on property ownership, boundaries, zoning regulations, and tax information, ensuring informed decision-making for property owners, real estate professionals, and government officials.

Q: Is the Greene County Tax Map updated regularly?

A: Yes, the tax map is updated regularly to reflect changes in property ownership, land use, and tax assessments.

Tips for Utilizing the Greene County Tax Map Effectively:

- Familiarize yourself with the map’s features: Understand the key elements, such as PINs, boundaries, and land use classifications, to effectively navigate the system.

- Use the search function: Leverage the website’s search capabilities to locate specific properties quickly and efficiently.

- Verify information: Always cross-reference information obtained from the tax map with other sources, such as deeds or property records, to ensure accuracy.

- Contact the Assessor’s Office: If you have any questions or require assistance in interpreting the tax map, reach out to the Greene County Assessor’s Office for guidance.

Conclusion: The Greene County Tax Map – A Vital Tool for Navigating the County’s Landscape

The Greene County Tax Map serves as a comprehensive and accessible resource for navigating the county’s property landscape. It provides vital information for residents, businesses, and government officials, facilitating informed decision-making, efficient resource management, and equitable property ownership. By leveraging this valuable tool, stakeholders can gain a deeper understanding of the county’s land parcels, contributing to informed development, investment, and community growth.

Closure

Thus, we hope this article has provided valuable insights into Navigating Greene County, NY: A Comprehensive Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!